JAI HIND 15 AUGUST 2013

O/o The Principal A.G.(A&E), Haryana, Plot No.4&5, Sector-33/B, Chandigarh. Email: hcaaflag@gmail.com Website: hcaa-chd.blogspot.com

O/o The Accountant General (A&E), Haryana Chandigarh.

Sunday, 25 August 2013

A MEETING WAS HELD ON 23rd August 2013 BETWEEN CAG OFFICIALS & ALL INDIA AUDIT & ACCOUNTS OFFICE ASSOCIATION.

The

Bilateral meeting with Shri Shankar Narayan, DAI was held on 23rd

August 2013. Ms Annie G Mathew, DG, Staff, Shri Ranjit Singh, AC (N) and

Shri ML Tamrakar, AO/JCM were present from the official side. The Association

was represented by, besides the Secretary General, Comrades M Duraipandian,

President, Subhash Chandra Pandey, Vice President and Com V. Nageswara Rao,

Additional Secretary General.

Gist

of the discussion is given below. (Explanatory memorandum submitted by the

Association have already been published in the Auditlekha Samanvay of July

2013)

AT

the outset, we stated that the agenda for discussion is the Charter of Demands,

which is always a combination of statement of organisational position on issues

and declared goals along with specific demands.

1.

Strengthen Audit & Accounts to Safeguard People's Rights

Stop down-sizing;

Stop outsourcing & privatisation of Audit & Accounts; Scrap

Curtailment/shedding of Audit functions in the name of Audit

Plan; ensure continuance of the existing Accounting and Auditing methodologies

and appropriate party days with scientific work norms; ensure effective

Panchayati Raj Audit & Accounts by sanctioning adequate posts; revisit

restructuring of Audit effected from 1..4. 2012.

A detailed

discussion took place on the agenda. DAI explained that the expansion of PRI

audit is not possible as the State Govts are unwilling to handover the Audit to

CAG.

It was assured that the staff

related problems on account of the restructuring of Audit with effect from

1.4.2012 would be looked into. From our side, we expressed our concern over the

drastic reduction in the compliance/transaction audit.

2.

a) Amend Company Law and DPC Act for Audit of Public Sector

Undertakings & Corporations even after

reduction of Government share to below 50%.

b) Amend Company Law to ensure the Audit

by IA&AD of all Public Limited Companies listed with Securities

and Exchange Board of India (SEBI)

c) Enact necessary law to bring audit of all public Financial

Institutions by IA&AD.

There was no discussion on the matter. We sought the co-operation of the

authorities in involving ourselves in campaigns on these positions as also on

issues stated at 1. The energy of the Association is forced to be diverted on

fighting victimisation of its leaders and cadres.

3. Restructure the

audit/accounts cadres as per submitted by this Association &:

i) De-merge the erstwhile Record Keeper from MTS and be granted GP of 1900.

ii) Upgrade the cadre of LDC and re-designate as Audit Assistant with GP of

2400. Existing LDCs may be promoted as Auditor (Accountant) as a onetime

measure.

Grant the following Grades Pay to other cadres

Auditor/Accountant – 4200,

SA

– 4600,

AAO – 4800 & 5400 (PB2) on completion of 4 years,

AO– 6600

SAO

- 7600

iii) Ensure equal opportunity in promotion to stenos of the same

station.

The Association stated that it would submit a more comprehensive note on

restructuring of cadres.

We submitted the position that the record keepers who were Gr C prior to CCS

(RP) 2008 are now clubbed with erstwhile Gr D and forced to do such jobs as of

watchmen etc. We therefore demanded that the post of RK may be delineated from

MTS with GP 1900. We further submitted that the LDC posts may be abolished and

upgraded to GP 2400 merging with DEO. We also insisted that there should be no

separate cadre of DEO as it would not have promotional prospects.

DAI appreciated the position and said it would be examined.

The promotional prospects of Stenographers in the field offices were also discussed.

DAI stated that the concern expressed is well taken and effort to find a

solution would be attempted.

4. a) Vacate victimisation of

Association activists.

b) Allow democratic functioning of Association without interference from administration

We explained the position existing in various offices. DAI assured to examine

the issue.

As regards denial of special casual leave, non granting of meetings by

Accountants General, obstructing functioning of the Association etc. it

was assured that instructions in this regard would be issued afresh.

The issue of blanket denial of permission for holding demonstration in the

office premises was raised by us and requested that the specific Para in the

Circular issued in February 2012 may be deleted.

5.

Fill Up all

vacant posts through local recruitment.

There was a detailed discussion on the subject. The need for knowledge of local

language by our personnel was accepted by DAI. We proposed that we may de-link

from SSC and adopt the recruitments method adopted by Postal Deptt. where the

criteria is only the marks scored by the applicant in the University or Board

exams.

DAI assured to take up the matter with SSC, pointing out the functional

requirement of the department.

6. i) Withdraw annual audit criteria

introduced vide letter dt 27 January 2011.

ii) Stop unilateral implementation of transfer policy in Commercial Audit &

P&T Audit

On both the points, DAI assured to cross check with concerned wings.

7. Implement Arbitration Award on SA

pay Scale

The item was not further discussed as it is already being pursued with Govt of

India.

8.

Permit all Employees in the GP of 1800 to appear

for all Departmental Exams including SOGE.

DAI did not agree with the proposal of the Association.

The Association was informed that DOPT is objecting to the present system

of SAS examination fast tracking promotion to AAO.

9. Extend benefits of MACP to Assistant

Audit/Accounts Officers by treating promotion to AAO as

direct recruitment; withdraw the order treating promotion from Section Officer

to Assistant Audit Officer between 01.01.2006 to 01.09.2008 as null and void.

The Association made a detailed presentation on the item. DAI appreciated the

situation and assured to have the issue examined afresh.

On being explained that department has issued circular giving option for pay

fixation in the case of those affected by "null & void" circular,

part II of the item was not discussed further.

10. Designate Supervisor as AAO & Earmark 20% of

AAO post for seniority cum fitness

promotion

Re-designation of Supervisor as AAO was not agreed to. DAI assured to examine

the demand for raising the percentage of Supervisor post.

11.

Remove differential treatment on pay

fixation on promotion vis-à-vis direct recruitees in all cadres.

The item was not discussed as it is to be decided by the Deptt of Expr. We were

informed that the Deptt is pursuing the matter.

12.

Stop downsizing of P&T Audit Offices; conduct audit of private service

providers as per TRAI regulations.

We were told that more than 300 Auditor/DEO have been recruited in various

P&T Audit in the recent past.

DAI agreed to examine the demand for audit of private service providers.

13.

Re-imburse

hotel charges to Railway Audit personnel wherever Railway accommodation is not

allotted while on tour.

The demand was appreciated; it was informed that the issue cannot be resolved

without taking Railway Board on board. We were assured that efforts would be

made in this regard.

14.

Restore

unilateral transfer policy.

Not agreed to – for the reasons that vacancy position is yet to be at

satisfactory level and majority of the recruits are from outstation.

DAI stated that the relaxation can be considered only for physically

handicapped personnel-after a cooling period.

15.

Restore

metal Pass facility to AAOs in Railway Audit

The demand was appreciated. It was clarified that the issue is to be pursued

with Railway Board and would be taken up.

16.

Grant

increment and Grade Pay of 4800 from the day of Passing of SOGE

After

detailed discussion, we requested that during the waiting period – this

position is acute in the cases of Commercial audit SAS passed candidates and Civil

audit SAS passed candidates from A&E wing – the SAS passed candidates may atleast

be granted one increment ie 3% of the pay, till promotion or transfer,

as the case may be.

DAI

agreed to have the demand examined.

In

addition to the items listed above, we also raised the issue of additional

chances for SAS examination as well as the introduction of negative marks for

SAS and incentive/RA exam.

DAI

assured to look into the matter.

On

the issue of arrears of pay in the light of judicial pronouncements on the case

filed of comrades of Railway Accounts from Thiruvananthapuram, we were informed

that Department is following up the matter with Govt.

Source: A.I.A. & A.A. dated 25 Aug 2013.

Friday, 23 August 2013

Retirement Age 62 – Again denied in Parliament

While answering to a question in Parliament today on 22nd August 2013, the Minister of Personnel, Public Grievances and Pensions Shri. V.Narayanasamy told that "At present there is no proposal to increase the age of retirement of Government employees".

He also included, as per fundamental Rules 56(a) except as otherwise provided, every Government servant shall retire on attaining the age of 60 years.

The formal announcement about this proposal was looked to be declared, a week before. Now, it has been denied once again by the Central Government in Parliament to not pursue the policy of increasing the age of retirement of Central Government staff.

While answering to a question in Parliament today on 22nd August 2013, the Minister of Personnel, Public Grievances and Pensions Shri. V.Narayanasamy told that "At present there is no proposal to increase the age of retirement of Government employees".

He also included, as per fundamental Rules 56(a) except as otherwise provided, every Government servant shall retire on attaining the age of 60 years.

The formal announcement about this proposal was looked to be declared, a week before. Now, it has been denied once again by the Central Government in Parliament to not pursue the policy of increasing the age of retirement of Central Government staff.

Monday, 19 August 2013

F.A.Q ON CHILD CARE LEAVE

Q Who are entitled for Child Care Leave?A Child Care Leave can be granted to women employees having minor children below the age of 18 years, for a maximum period of 2 years (i.e. 730 days) during their entire service, for taking care of up to two children whether for rearing or to look after any of their needs like examination, sickness etc. Child Care Leave shall not be admissible if the child is eighteen years of age or older.

Q Am I eligible to draw Salary for the period for which Child Care leave is availed?

A During the period of such leave, the women employees shall be paid leave salary equal to the pay drawn immediately before proceeding on leave.

Q Whether CCL can be debited against any other type of Leave admissible to the employee?

A Child Care Leave shall not be debited against the leave account. Child Care Leave may also be allowed for the third year as leave not due (without production of medical certificate).

Q Whether Child Care Leave can be combined with any other leave?

A It may be combined with leave of the kind due and admissible.

Q Whether Child Care Leave is applicable for third child?

A No. CCL is not applicable to third Child.

Q How to maintain Child Care Leave account?

A The leave account for child care leave shall be maintained in the proforma prescribed by Govt, and it shall be kept along with the Service Book of the Government servant concerned.

Q Whether CCL can be claimed as a matter of right?

A The intention of the Pay Commission in recommending Child Care Leave for women employees was to facilitate women employees to take care of their children at the time of need. However, this does not mean that CCL should disrupt the functioning of Central Government offices. The nature of this leave was envisaged to be the same as that of earned leave.

Q Whether we can prefix or suffix Saturdays, Sundays, and Gazetted holidays?

A As in the case of Earned Leave, we can prefix or suffix Saturdays, Sundays, and Gazetted holidays with the Child Care Leave.

Q Should we have any Earned Leave in Credit for the purpose of taking Child Care Leave?

A There was a condition envisaged in the Office Memorandum relevant to Child Care Leave to the effect that CCL can be availed only if the employee concerned has no Earned Leave at her credit. However, this condition was withdrawn by the Government and as such there is no need for having EL in credit to avail CCL.

Q Whether CCL can be availed without prior sanction?

A Under no circumstances can any employee proceed on CCL without prior approval of the Leave sanctioning authority.

Q Can we avail CCL for the children who are not dependents?

A The Child Care Leave would be permitted only if the child is dependent on the Government servant.

Q Is there any other conditions apart from the total number of holidays and the age of the child?

A The Conditions regarding spell of CCL, imposed upon by the Government are that it may not be granted in more than 3 spells in a calendar year and that CCL may not be granted for less than 15 days.

Further, CCL should not ordinarily be granted during the probation period except in case of certain extreme situations where the leave sanctioning authority is fully satisfied about the need of Child Care Leave to the probationer. It may also be ensured that the period for which this leave is sanctioned during probation is minimal.

Q Whether Earned Leave availed for any purpose can be converted into Child Care Leave? How should applications where the purpose of availing leave has been indicated as 'Urgent Work' but the applicant claims to have utilized the leave for taking care of the needs of the child, be treated?

A Child Care Leave is sanctioned to women employees having minor children, for rearing or for looking after their needs like examination, sickness etc. Hence Earned Leave availed specifically for this purpose only should be converted.

Q Whether all Earned Leave availed irrespective of 'number of days i.e. less than 15 days, and number of spells can be converted? In cases where the CCL spills over to the next year: for example 30 days CCL from 27th December, whether the Leave should be treated as one spell or two spells'?

A No. As the instructions contained in the OM dared 7.9.2010 has been given retrospective effect, all the conditions specified in the OM would have to be fulfilled for conversion of the Earned Leave into Child Care Leave. In cases where the leave spills over to the next year, it may be treated as one spell against the year in which the leave commences.

Q Whether those who have availed Child Care Leave for more than 3 spells with less than 15 days can avail further Child C31.e Leave for the remaining period of the current year'?

A No. As per the OM of even number dated 7.9.2010, Child Care Leave may not be granted in more than 3 spells. Hence CCL may not be allowed more than 3 times irrespective of the number of days or times Child Care Leave has been availed earlier.

Q Whether LTC can be availed during Child Care Leave?

A LTC cannot be availed during Child Care Leave as Child Care Leave is granted for the specific purpose of taking care of a minor child for rearing or for looking after any other needs of the child during examination, sickness etc.

Q Whether Child Care Leave is applicable to All India Services?

A Yes. Child Care Leave is applicable to employees under All India Services.

With regard to the documents for family pension, including certificate of income, required to be submitted by a claimant member of family (other than spouse) along with application form (Form 14), PPO and death certificate after the death of a pensioner/family pensioner, the Department of Pension & Pensioners Welfare has clarified that the claims submitted by a claimant member of family (other than spouse) for family pension after the death of a pensioner/family pensioner, in Form 14 and supported by the death certificate and PPO of the pensioner/family pensioner, may be processed in consultation with the Pay and Accounts Officer, who is the custodian of the pension file which contains all relevant Forms and information of the pensioner. In a very rare case where the name of the claimant member is not available in the records of the Head of Office as well as the Pay & Accounts Officer concerned and the claimant member also fails to submit a copy of PPO or Form 3 containing 'Details of Family submitted earlier by the deceased employee/pensioner, the certificates prescribed at serial number 9(v) of Form 14 may be accepted. In addition to these certificates, PAN Card, Matriculation Certificate, Passport. CGHS Card, Driving License Voter's ID card and Aadhar Number may also be accepted. Acceptance of voter's ID card and Aadhar Number is subject to the condition that the pensioner/family pensioner certifies that he/she is not a matriculate and he/she does not have any of the documents mentioned in Form 14 or above Apart from these documents, the Ministries/Departments may accept any other document submitted by the claimant, which may be relied upon and which establishes the relationship of the claimant with the pensioner and/or contains his/her date of birth.

The applicant has also to prove that no other surviving member in the family, who may have a prior entitlement for family pension is eligible. For this purpose, the above and/or any other documents, such as marriage/death/income certificates of the other members which may be essential in a given situation may be used.

Sunday, 18 August 2013

Children Education Allowance can be claimed even in case of loss of fee receipts.

Whether Children Education Allowance can be allowed if the employee lost the original School fee receipt ?

Till now, the CEA granting authorities were straightaway denying the CEA on the ground of non-production of original school receipts.

The DOPT has now clarified on this issue that in case of misplacement of School fee receipts, reimbursement may be allowed if the Government servant produces a duplicatereceipt, duly authenticated by the school authorities.

This Clarification has been issued by DOPT in its Office Memorandum No.12011/07(i)/2011-Estt.(AL) dated 21.02.2012, along with other clarifications on the basis of doubts raised by Central Government Employees and various Ministries and Departments.

No.12011/07(i)/2011-Estt.(AL)Government of IndiaMinistry of Personnel, Public Grievances and PensionsDepartment of Personnel and TrainingNew Delhi, 21st February, 2012OFFICE MEMORANDUMSubject: Children Education Allowance – Clarification.The undersigned is directed to refer to Department of Personnel & Training’s O.M. No.12011/03/2008—Estt.(Allowance) dated 2nd September, 2008, and subsequent clarifications issued from time to time on the subject cited above, and to state that various Ministries / Departments have been seeking clarifications on various aspects of the Children Education Allowance / Hostel Subsidy. The doubts raised by various authorities are clarified as under:

S.No. Point of reference/doubts Clarification 1. What constitute “Fee” as per para 1(c) of the O.M. dated 2/9/2008 and whether fee paid for extra-curricular activities to some other institute and reimbursement of, school bags, pen/pencils. etc., can be allowed? Is there any item-wise ceiling? “Fee’ shall mean fee paid to the school in which the child is studding, directly by the parents/guardian for the items mentioned in para 1(e) of the O.M.dated 2/9/2008. Reimbursement of school bags, pens/pencils, etc., may not he allowed. There is no item-wise ceiling. 2. Whether reimbursement can be allowed in case the original receipts are misplaced andduplicate receipts are produced by the Government servant? In case of misplacement of receipts given by the school/institution towards charges received from the parents/guardian, reimbursement may be allowed if the Government servant produces a duplicate receipt, duly authenticated by the school authorities. Receipts from private parties, other than the school, if misplaced shall not be , entertained, even if a duplicate receipt is produced. Original receipts from school authorities need not be attested / countersigned stamped by the school authorities. 3. Whether the Government servant is allowed to get 50% of the total amount subject to the overall annual ceiling in the first quarter and the remaining amount in third and orfourth quarter? Reimbursement of 50% of the entitled amount for the academic year could be allowed in the first and/or second quarter and the remaining amount could be reimbursed in the third and/or fourth quarter. However,the entire entitled amount can be reimbursed in the last quarter. 4. It is provided that whenever the DA increases by 50% the CEA will increase by 25%. What shall be the date of effect of such enhancement? Any enhancement in the ceiling of reimbursement per annum due to increase in DA by 50%, shall be applicable on pro-rata basis from the date of increase in DA, subject to actual expenditure during the quarter. Hindi version will follow.sd/-(Vibha G.Mishra)Director

Saturday, 17 August 2013

Centre's proposed DA hike too little too late: BJP

Delhi BJP today termed hike in dearness allowance (DA), proposed to be announced by the government, as 'too less and too late' and demanded its merger with the employees' basic pay.

Source: economictimes dated Aug-05-2013

"In the wake of rising prices of all essential commodities, inflation has been hurting not only government employees but also the poor and the middle class. The latest DA hike proposed to be announced by the government is too less and too late," said Delhi BJP President Vijay Goel.

Goel said the Fifth Pay Commission had recommended that if the DA crosses more than 50 per cent then it should be clubbed with the basic pay.

"This provided some relief to government employees. But this was discontinued in the Sixth Pay Commission. Thus, at present,

DA is more than 80 per cent of the basic pay but it is not made part of

the basic pay. Now, the DA is expected to increase by 10 to 11 per cent

but the government is not waking up," he said in a statement.

The Delhi BJP chief said the government should set up the Seventh Pay Commission.

Source: economictimes dated Aug-05-2013

Friday, 9 August 2013

Sunday, 4 August 2013

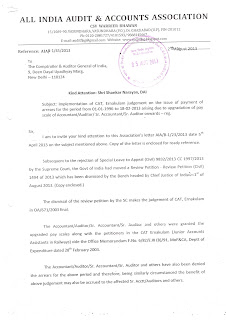

Pay parity arrears Review petition filed by govt. is resected by Supreame Court.

DECISION ON REVIEW PETITION

ITEM NO.25 COURT NO.2 SECTION XIA

S U P R E M E C O U R T

O F I N D I A

RECORD OF PROCEEDINGS

Petition(s) for Special Leave to

Appeal (Civil)....../2013

CC 1997/2013

(From the judgment and order dated 27/03/2012 in WPC No.22276/2007 of The

HIGH COURT OF KERALA AT

ERNAKULAM)

UNION OF INDIA & ORS. Petitioner(s)

VERSUS

JOSE SEBASTIAN & ORS. Respondent(s)

(With appln(s) for c/delay in

filing SLP)

Date: 25/02/2013 This Petition was called on for hearing

today.

CORAM :

HON'BLE MR. JUSTICE P. SATHASIVAM

HON'BLE MR. JUSTICE JAGDISH SINGH

KHEHAR

For Petitioner(s) Ms. Manita Verma,Adv.

Ms. Sukhbeer Kaur

Bajwa,Adv.

Mr. Shreekant N.

Terdal,Adv.

For Respondent(s) Ms. Sumita Hazarika,Adv.

Mr. Ezekial Jarain,Adv.

UPON hearing counsel the Court made

the following

O R D E R

Heard learned counsel for the

parties and perused the

relevant material.

Delay condoned.

We do not find any legal and valid ground for interference.

The special leave petition

is dismissed.

[Madhu Bala] [Savita Sainani]

Sr.PA Court Master

Subscribe to:

Comments

(

Atom

)

.jpg)